While we were still living in Houston, I drove to Louisiana one day for work and encountered the following billboard outside of Beaumont:

“24 YEARS.

BYE, GLENN”

It has always intrigued me. Sorry no picture.

While we were still living in Houston, I drove to Louisiana one day for work and encountered the following billboard outside of Beaumont:

“24 YEARS.

BYE, GLENN”

It has always intrigued me. Sorry no picture.

We all live with it these days… the steady rise in the price of food. We have to control it or it will, as the old saying goes, eat us out of house and home. Inflation is the direct result of the pandemic and its response, lockdown, supply chain disturbances and the mighty toll these factors have and continue to take on commerce and labor. I believe there are a few greedy bad actors, but that most of us are just trying to survive a perfect storm of catastrophes.

We all live with it these days… the steady rise in the price of food. We have to control it or it will, as the old saying goes, eat us out of house and home. Inflation is the direct result of the pandemic and its response, lockdown, supply chain disturbances and the mighty toll these factors have and continue to take on commerce and labor. I believe there are a few greedy bad actors, but that most of us are just trying to survive a perfect storm of catastrophes.

Like many others, I have decided that I have to do more about it. Difficult choices are sometimes involved. I now address my bi-weekly shopping as if battling a deadly foe. Our families and our livelihoods depend upon it.

Battle Plan:

Make and live on a budget. I calculated how much I spent in 2020 on foodstuffs prior to the pandemic. I used sales receipts. Then I added 2% to the total for each year since and set my budget. 2% per annum is the number the Federal Reserve shoots for in its efforts to curb inflation.

In short, I try not to spend any more on food now than I did in 2020 with 2% per annum/8% total added in. Drastic measures are required at times.

Identify, organize and use what I have on hand. This is probably the second most important activity to controlling cost. I refuse to let food that I have already bought and paid for go to waste. If I’m facing an expiration deadline, sometimes I go ahead and prepare the dish and freeze it. Some people can theirs, but that’s an investment of money I don’t need to make at this time.

I try to keep the fridge cleaned out and foods, snacks and leftovers that should be eaten first displayed up front. Otherwise, they get pushed to the rear and morph food waste. I set a reminder on my phone to clean out the fridge on Thursday afternoon 5 p.m. as Friday is garbage day.

I try to keep my pantry well-organized. Cans and foodstuffs are organized by expiration and best by dates. Last night, the other cook in the family substituted a can of lentil soup that was approaching it’s best buy date for another veggie. It worked well.

Carefully choose my vendor. I shop at a nearby supermarket, saving gas expense. The supermarket offers good pricing, many house branded products and a wide variety of foodstuffs, many grown nearby.

I buy in bulk only when there is a high probability we will consume it.

I still shop some at Amazon and serve a little more canned fruit than I used to. Fresh fruit is better, of course, but substituting some canned fruit is okay. Amazon sometimes runs great specials on bulk canned fruits and veggies, but you have to be prepared to work with a shortened shelf life. I think Amazon offers a full refund if you can prove they sent you an expired item, but you would need to check with them on this. And they deliver heavy canned goods to your front door… free of extra charge if you are a Prime Member. (Remember to include your Prime Membership cost in your food budget.)

Consider package deals carefully: “My supermarket” also offers a wide variety of coupon and package deals, but, when I take advantage of package deals, I usually end up with at least one product my family refuses to try. So I don’t do this often.

Use House Brands When Justified. I use house brands when justified by quality, taste, nutrition and family acceptance. I buy house brand bread instead of the loaf I really prefer. It tastes just as good, but the slices are slightly thicker, so I compensate by eating only a half sandwich instead of a whole sandwich to make the loaf go just as far as the preferred loaf. I don’t expect other family members to do this.

Save on measurable expenses:

Mileage costs. AAA calculates the average cost per mile driven at 17.99 cents which includes most measurable auto expenses. This is, of course, not the same as the $0.67 per mile that IRS allows for business purposes deduction for 2024. If you shop for a restaurant business you own, you can deduct $0.67/mile driven in 2024 from your taxes owed. If you are shopping for yourself and your family, you get no mileage deduction, but you should include driving costs at 17.99 cents per mile as part of your food budget calculations.

Include sales taxes in food budget. Texas charges sales tax on a limited number of food items which is deductible from taxes if it rises to a certain threshold. You should consider finding out what this amounts to where you live and shop. It varies from state to state.

Comparison shop. I compare prices, calculating both overall and serving prices. Advertised bargains are not always the best way to go. Serving price = Total price including any tax divided by the number of servings listed on the nutrition label. Sometimes the more expensive item turns out to be the best value… assuming most or all servings will be consumed. (Serving size is usually 1/2 cup. Don’t worry if your husband is a BIG GUY who eats way more than 1/2 cup at a time, go ahead and use the item’s serving cost as listed in budget calculations. It works out in the long run.)

Make do with fewer luxury goods. One family member has taken it as his personal goal to catch enough fresh fish to limit the fish I buy. He’s doing a stellar job. I supplement by making house brand tuna salad more often, but remain conscious of not serving too much tuna that contains too many heavy metals.

Include more low-budget but high quality items in our food budgets. Eggs, dried beans and lentils, canned tuna and meatless pasta dishes offer a wide variety of excellent budgetary choices.

Stay informed about coming shortages, gluts and price hikes. My sister Lynn manages her food budget better than I do. We alert each other when we read about a coming shortage or price hike. Sometimes we act upon the news, but it’s probable that such responses increase, not decrease, supply chain disturbances… certainly not our goal, but some difficult choices have to be make.

Eat at home. The biggest food budget money saver is to eat at home. We rarely eat out or order in. Seriously. We got used to it during the lockdown, and we’ve continued it. We are blessed with two cooks in the family, so that the principal cook gets a much-needed day off from time to time. I hate that our actions hurt the restaurant business recovery. But my family comes first. This amounts to a very hard choice.

Best of luck with your own efforts to cut food inflation. I hope I’ve given you at least one hint that might help your efforts.

I woke up hours before dawn on Tuesday, March 26, 2024 to the news that the Francis Scott Key Bridge in Baltimore had collapsed after being struck by a huge container ship. Incredible video soon followed. It was utterly appalling that such a seemingly minor incident could result in major loss of life and catastrophic damage. A few years earlier, while having dinner with a friend on the waterfront in Seabrook, Texas, we witnessed a dinner cruise ship lose control in blustery winds and come come close to careening into a pylon supporting the bridge over the Clear Lake Cut on Texas Highway 146. Of course, both the ship and the bridge in that instance were many times smaller than their counterparts in Baltimore. I ruled out any future dinner cruise with Chocoholic.

Like the Pittsburgh bridge collapse that I blogged about earlier, I had a brief, but memorable, past history with the Baltimore bridge. Just like the Fern Hollow Bridge, I was with a group of friends. We were in town for meetings in Baltimore and at the Capitol in Washington, D.C. I had a rental car, and we drove to a local seafood restaurant for lunch. For some unknown reason, I either forgot or didn’t notice that the trip would require crossing the giant bridge. I fear heights and avoid big bridges whenever possible, but I messed up big time in Baltimore. Immediately before encountering the bridge, a huge green freeway sign warned me that it lay dead ahead. There was no turnaround available that I could see. I told myself that I could do it, that I wouldn’t panic. The lives of others as well as my own depended on my successfully crossing the bridge. Most of all, my self respect depended on it. We immediately started to climb what seemed like the steepest bridge I had ever crossed. I managed to conceal my distress from the other ladies, blocked out their conversation and crossed successfully.

When we reached the other side, I breathed a great sigh of relief, and we enjoyed the rest of the day. But the memory still haunts me.

I want to tell you a little bit about one the key characters in the first book of the series, known simply as PIG PARTS. Jessie, our heroine Bess’s little sister, is a good child and a real nature lover.

I want to tell you a little bit about one the key characters in the first book of the series, known simply as PIG PARTS. Jessie, our heroine Bess’s little sister, is a good child and a real nature lover.

Jessie’s life has not been an easy one. Bess and Jessie’s mother left them when Jessie was just a baby and Bess was eight years old. Jessie misses having a real mother, even though Bess fills the role as best she can. Jessie still suffers hurt from her mother’s abandonment.

When Jessie is in kindergarten, she and Bess are forced by circumstance to leave their father and move from Austin to their grandparents ranch in Central Texas. Jessie adores ranch life and thrives. Bess teaches her to swim in the stock tank. The photo represents Jessie jumping into the tank, a quick way to cool off in the blistering summer heat. She captures and cares for non-poisonous snakes and a Mexican Red Leg Tarantula. The centerpiece of her pet collection is an ugly snub-nosed Texas Water Snake.

Jessie is smart and bold and decisive. She loves silliness and fun of all kinds. Unfortunately, her years at the ranch are numbered, and when she is twelve, she and Bess move back to Austin. This time they live on their own in an apartment, and Bess attends the University of Texas.

Before I owned a Smartphone, I owned a Flip phone… a very good flip phone. I selected it carefully, planning to use it for years. It worked fine, great even, and I enjoyed using it. It was small, convenient, sturdy and protected in its own attached hard-shell plastic case. It didn’t break whenever I dropped it. Even better, it fit perfectly into my cross-body bag. It even met military specifications.

Before I owned a Smartphone, I owned a Flip phone… a very good flip phone. I selected it carefully, planning to use it for years. It worked fine, great even, and I enjoyed using it. It was small, convenient, sturdy and protected in its own attached hard-shell plastic case. It didn’t break whenever I dropped it. Even better, it fit perfectly into my cross-body bag. It even met military specifications.

One weekend when I was back home after a long and difficult week of travel, I got up very early and started laundry. I travelled a great deal at that time, and clean clothes were always a treat. I was tired and made a big mistake. When I transferred my wet clothes from the washing machine to the dryer. I found my precious flip phone in a soggy pocket. I felt sick. The phone contained literally hundreds of personal and business telephone numbers for loved ones, friends, family, clients and consultants. I dreaded having to enter all those numbers manually into a new phone.

I allowed the phone to dry out. I didn’t know then that embedding it in dry rice might help the process… I simply air dried it. Finally I turned it back on and braced myself for bad news.

IT WORKED JUST FINE! It never missed a step. A few years later I was forced by society and convenience to replace it with a Smartphone. I still love that sturdy little Flip phone.

Years ago, Chocoholic and I spent a few days at Caesar’s Palace in Las Vegas. One morning we changed into our swimsuits and went to the pool. It was a windy day. We both swam laps for exercise in the icy water. I love to swim. I’m a slow, but steady swimmer. When I was done, I climbed out of the pool, dried off and relaxed on a chaise lounge.

The wind picked up and blew a piece of paper to me that stuck to my chest. I peeled it off. It was a $20 bill.

A winner, in Vegas! Yea!

A few years ago, we met friends in Venice and joined a cruise in the Mediterranean. Chocoholic and I arrived the night before and stayed in a small hotel near St. Mark’s Square. We walked to a nearby trattoria for an early dinner. We were the only patrons, and there was only a single waiter present, a young man, much younger than us.

We enjoyed our pizza. When we asked for the check, the waiter said there was no charge. That was a big surprise. I asked him why no charge, and he responded, because it’s for you. That was another big surprise, but I had no more questions. We gave him a very nice tip and returned to our hotel.

I never figured out why he didn’t charge us. We’re not famous or beautiful or unique in any way, but we enjoyed our dinner and the hospitality.

SPOILER ALERT: The following sounds suspiciously like a rant.

SPOILER ALERT: The following sounds suspiciously like a rant.

I’m a news junkie. I try to keep up. I follow food, health and medicine; war, catastrophes and disasters; writing and publishing; business, finance & investments; and baseball. Too many so-called “news articles” these days waste my time.

Many articles deliberately don’t get to the point until one has scrolled through endless paragraphs of detailed background. While the background is usually quite worthwhile, it suits me better to have it slotted after the advertised point as I’m usually already aware of the background. Too many articles never get to the advertised point, they just ramble. Click bait still occasionally lures me into opening new tabs with endless advertisements for whatever I don’t need, but I’m wising up about them. And bait and switch articles promise specific items of interest but never deliver. And then there is the recent plethora of articles that inform me of each and every freaking thing the well-meaning author assumes that I’m doing wrong.

For example, a fictional headline might read: “ONE HUNDRED MISTAKES YOU MAKE COOKING POTATOES!” I naively figure that given a veritable landslide of instructions to follow, at least a few will prove worthwhile, but, no! Each and every one turns out to be far too simplistic. Only a complete dolt would make such idiotic mistakes… like cooking a potato that has obviously been invaded by a big fat wiggly worm. Come on, guys. Give your readers credit for possessing a modicum of common sense!

Stop wasting our time.

Sorry… I couldn’t help myself. It was indeed a rant.

Years ago, it snowed in Houston on Christmas Eve, a very BIG DEAL. Early Christmas morning, Chocoholic and Jack, our beloved Black Lab, and I drove to a nearby park. The day was grey and overcast, and the snow was still on the ground. We took a box of crackers and cans of cat food to feed the ducks and the feral cats.

Years ago, it snowed in Houston on Christmas Eve, a very BIG DEAL. Early Christmas morning, Chocoholic and Jack, our beloved Black Lab, and I drove to a nearby park. The day was grey and overcast, and the snow was still on the ground. We took a box of crackers and cans of cat food to feed the ducks and the feral cats.

I held the crackers and Jack’s leash while Chocoholic took the cat food and the can opener over to the place where the cats hung out. As he began opening cans, we noticed a gentleman coming toward us off the pier, obviously intent on greeting Beautiful, Never Met a Stranger Jack. Jack was a big dog. He took off toward him in a flash. I flew through the air (full horizontal, Scout’s Honor!) and landed on my back, my breath knocked out of me. The box burst open and crackers rained down around my head. Jack instantly transferred his attention from the man to the crackers. I lay there, catching my breath while Jack’s massive jaw gobbled up crackers around my head. “SNAP! SNAP! SNAP!” He consumed at least half a box of crackers while Chocoholic and the other gentleman helped me to my feet. I was unhurt.

Unfortunately there was little Christmas cheer left for the ducks, but Chocoholic, Jack and I had a most memorable White Christmas. I wish you all the Happiest of Holidays.

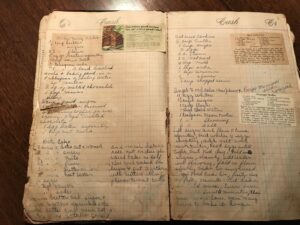

Sometime around the start of the pandemic lockdown, I promised my sister that I would find Grandmother’s Cook Book. Lynn wanted a copy of a favorite cookie recipe. I finally found the book the other day, some 3 years later, cookie recipe included. Lynn graciously avoided mention of the long delay and said that she’d get right on it.

Sometime around the start of the pandemic lockdown, I promised my sister that I would find Grandmother’s Cook Book. Lynn wanted a copy of a favorite cookie recipe. I finally found the book the other day, some 3 years later, cookie recipe included. Lynn graciously avoided mention of the long delay and said that she’d get right on it.

We lived with my grandmother while we were growing up. She did the bulk of the cooking and was an excellent cook. Mother was a good cook but worked full time and cooked infrequently. My grandmother taught me how to cook. For many years, I considered myself a good cook but then gradually found myself cutting corners, using too many convenience foods. In my quest for a healthier diet, I have changed my ways, but I’m not really a good cook anymore.

My sister Lynn is a better cook than I am, and she, too, cooks most meals. She bakes regularly and is into sourdough and artisan flours. She made a lemon meringue pie yesterday and sent me a picture. See attached. (Obviously she’s a better photographer than I am too.) She confirms the pie is as yummy as it looks.

My grandmother’s cook book is an old-fashioned hardbound ledger book. It has been used for so long that it’s coming apart at the seams. It includes a wide variety of foods, especially baked goods, punches, homemade ice creams and hostess foods for times past. She routinely made lemon meringue and ice box pies; many different kinds of cookies; various chocolate, devil’s food, banana and angel food cakes; banana and rice puddings; and Christmas candies, all from scratch. The big deal every year when she was alive was making a huge, heavy, dark fruit cake at Thanksgiving and soaking it in bourbon until Christmas. I still love fruit cake but haven’t made one in a long time. When I eat sweets these days, they’re usually purchased and sugar free. Chocoholic, my husband would love for me to bake more cookies, but I’m afraid that I continually disappoint him.

In mid-June, my dermatologist asked me how I was spending my summer. I replied that I was avoiding the heat and the sun as much as possible, knowing he’d approve the point about avoiding the sun. Low temperatures were already in the 80’s, and highs were in the mid to high 100’s accompanied by oppressive humidity. We had not yet made it into the 110’s, but they were threatening and did, of course, occur. Flash and I began walking indoors to avoid heat stroke.

In mid-June, my dermatologist asked me how I was spending my summer. I replied that I was avoiding the heat and the sun as much as possible, knowing he’d approve the point about avoiding the sun. Low temperatures were already in the 80’s, and highs were in the mid to high 100’s accompanied by oppressive humidity. We had not yet made it into the 110’s, but they were threatening and did, of course, occur. Flash and I began walking indoors to avoid heat stroke.

It occurred to me that much of my spring and summer had been spent playing nursemaid to family members and self. I say “playing,” because I’m no nurse. I have worked for years in health care, but in non-clinical roles. I’ve worked closely with many wonderful nurses and greatly appreciate the crucial role they play in medicine.

Like many others, my family and I postponed non-urgent health and dental care during the pandemic emergency. We have also sufferred an unusual number of unexpected illnesses and injuries this year, but we are finally getting caught up, or so I hope. During the last few months, we have collectively undergone minor surgical procedures; physical therapy sessions; dental crowns and fillings; treatment for burns; various dermatologic cryosurgeries; a course of antibiotics for a facial scratch from an ill-mannered, over-exuberant big dog; food poisoning; and an emergency appendectomy. Thank goodness for health insurance and continued good health!

What with family nursing duties, I have assembled what I consider to be an impressive First Aid Kit. I can care for simple wounds without first making a trip to the store. I’ve learned to anticipate what kinds of minor cuts, scrapes and burns may occur and stock up accordingly. It cuts down on aggravation and single-purpose errands… a good thing.